Ought i pay off my debt before applying for FHA financing?

You can aquire property that have bad credit, but remember that you might not qualify for an equivalent attract costs or conditions that you would feel if the borrowing is actually most readily useful.

Many traditional mortgage software require that you features at least credit rating or they don’t agree you after all

The new FHA mortgage specifications was 580 in order to be eligible for a great 3.5-percent-off mortgage and five-hundred to help you qualify for a good ten-percent-down financing, as Va doesn’t have personal credit rating tolerance (some loan providers perform).

That is why you have to make as numerous developments on the borrowing as you possibly can before applying to own a mortgage loan.

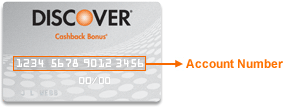

Begin by asking for a free of charge content of credit report, and that people are permitted discovered because of the Government Change Fee, by way of AnnualCreditReport. If you learn any errors, being more common than you may consider, argument her or him right away.

Up coming, check your balance in place of the amount of borrowing from the bank you really have; lenders want to see that you aren’t with the full matter of the readily available credit, thus create what you can to expend down balances. Generate all of your money punctually, too, since your fee history has plenty regarding your credit history.

While it is possible to invest in a house without a job, you may not qualify for down rates and better financing terms and conditions if you’re unable to show your revenue. You could potentially make an application for:

Inside the holder capital, you will be making costs directly to the owner of the home as an alternative rather than a lender

- A no-records mortgage: These loans are created to give loans to people whoever income is difficult to verify, like those who happen to be worry about-operating or keeps other sourced elements of money.

- A zero-ratio loan: A no-ratio mortgage is going to be beneficial if you have loads of assets as the bank will appear at worth of your assets unlike your income and make a credit decision.

You could also consider exhibiting proof money off their sources, such boy service, trust funds repayments or stock dividends. For a few people, the clear answer is a co-signer; the financial institution often believe his or her earnings along with your own. Eventually, holder funding is generally an alternative.

People can buy a home instead a home loan, possibly of the loan places Sterrett saving the cash to purchase a house downright otherwise that with seller capital.

Vendor resource, that is commonly called proprietor financial support, is when you invest in pay the residence’s proprietor a straight down commission to make monthly premiums. You can easily sign an effective promissory note proclaiming that you are able to pay the loan as well as the merchant cues along the deed to the family. Your commercially own our house, but the supplier are commercially your own bank – which mode owner is repossess if you don’t spend. Always, provider financing was a short-label arrangement, typically comprising an expression regarding about three and 5 years, and there is a good balloon fee due to the provider into remaining money at the end of the expression. At the time, you can either submit an application for old-fashioned investment or supply the provider dollars so you’re able to rectangular up.

Before you apply for your mortgage, you need to pay normally loans as you can. Paying otherwise paying your debt increase your borrowing from the bank score; which have a high credit history, you’ll be able to qualify for all the way down interest rates and better mortgage terms and conditions. If you’re able to, apply for a consumer loan which have a reduced-interest rate and you can repay your cards. If that’s extremely hard, envision altering balance on the high-interest notes to reduce-interest cards so you can spend less.