This new FHA Label step one Mortgage to possess Possessions Advancements

Federal Construction Administration (FHA) Term 1 Financing was a well-left miracle of the U.S. Department of Construction and you https://paydayloancolorado.net/hasty/ will Metropolitan Creativity. FHA regularly pledges mortgages created by acknowledged lenders, eg finance companies and you will borrowing unions, so you’re able to consumers with bad credit and you will reasonable revenues. It decrease the possibility of this type of mortgages on the lenders in the event of debtor default.

Do not have a tendency to hear about new FHA Name 1 Mortgage program, however it is a house improve, re also. We automatically think about making an application for property security mortgage otherwise a property guarantee personal line of credit (HELOC) to obtain the currency to possess home improvement or resolve. We can’t all be eligible for possibly the loan or the line from credit based on the guarantee in their home. This is where the fresh FHA Label step one Mortgage system steps in.

Secret Takeaways

- An FHA Label step one Loan are that loan offered to homeowners having home repairs, improvements, and you may home improvements that can enhance the worth of the home.

- When you are an initial-date homebuyer and also hardly any security on your own brand new home, you will want a keen FHA Type step one Loan for these programs in lieu of a great HELOC or household equity mortgage.

- The new installment name of the FHA Particular 1 Financing is between six months and you can 20 years and 32 months.

- The applying process to the FHA Method of step one Financing is similar to help you a mortgage. The lender have a tendency to eliminate the latest borrower’s credit file and look at their credit history. Earnings could well be featured too.

The basics of the fresh FHA Identity step one Financing

An FHA Name 1 Loan try that loan offered to property owners to possess household repairs, developments, and you will renovations that boost the value of the house. Since the FHA mortgage, FHA doesn’t make the loan. They promises the borrowed funds, produced by recognized loan providers, which are refunded in case there is default by homeowner. When you are to invest in a property that really needs repairs, you could potentially piggyback an FHA Label step 1 Loan on your first financial to solve up your brand new home. There are a list of acknowledged lenders toward Institution out of Housing and you can Metropolitan Invention site.

The problem Which have Domestic Equity

Home fixes otherwise developments be expensive, and never of a lot residents have huge amounts of cash open to security him or her. They have to remove financing and you may apparently gravitate towards by using the equity he’s in their home for this version of high costs. Discover cases where that isn’t you’ll be able to. If you are an initial-time homebuyer and now have little or no collateral on your own new house, you want an FHA Type of 1 Mortgage, specifically if you pick a beneficial fixer-upper.

- When you have refinanced your house in earlier times and have now already pulled the new guarantee from it, you might have to explore an enthusiastic FHA Sort of step one Loan when the you have an importance of home solutions or advancements.

- If you wish to reily affiliate with a disability and do not keeps much equity in your home, the FHA Type of step one Loan covers which utilization of the financing.

- For individuals who desire to help your house be more energy efficient, you can use an FHA Variety of step one financing making the individuals adjustment.

- If you would like add on a room or need certainly to put on a ceiling otherwise earn some most other high resolve otherwise improve that will add to the fair market value of your own home, a great FHA Kind of step 1 Mortgage will help defense one debts, whilst you ount limit.

Some home owners remain underwater on the mortgage loans after the construction bubble. These types of people lack guarantee inside their house and you may would need the assistance of the fresh FHA Identity 1 Mortgage program when they necessary to make developments otherwise solutions.

One thing you can not create which have an FHA Term 1 Loan are install any deluxe goods like a sauna, vapor area, or hot spa.

Limits and Terms

- For unmarried-nearest and dearest property, the borrowed funds restriction to possess FHA Particular step 1 Loans are $twenty five,000.

- To have multifamily property, the borrowed funds maximum to have FHA Sorts of step 1 Money is $sixty,100000, which have a threshold of $a dozen,100000 for each personal unit.

Equity is necessary in the way of your home except if this new quantity of the loan was below $seven,five-hundred. That implies should your debtor non-payments towards the loan, the lender can be foreclose on the dwelling. In the event the loan amount are below $7,500, then the loan is found on their trademark alone.

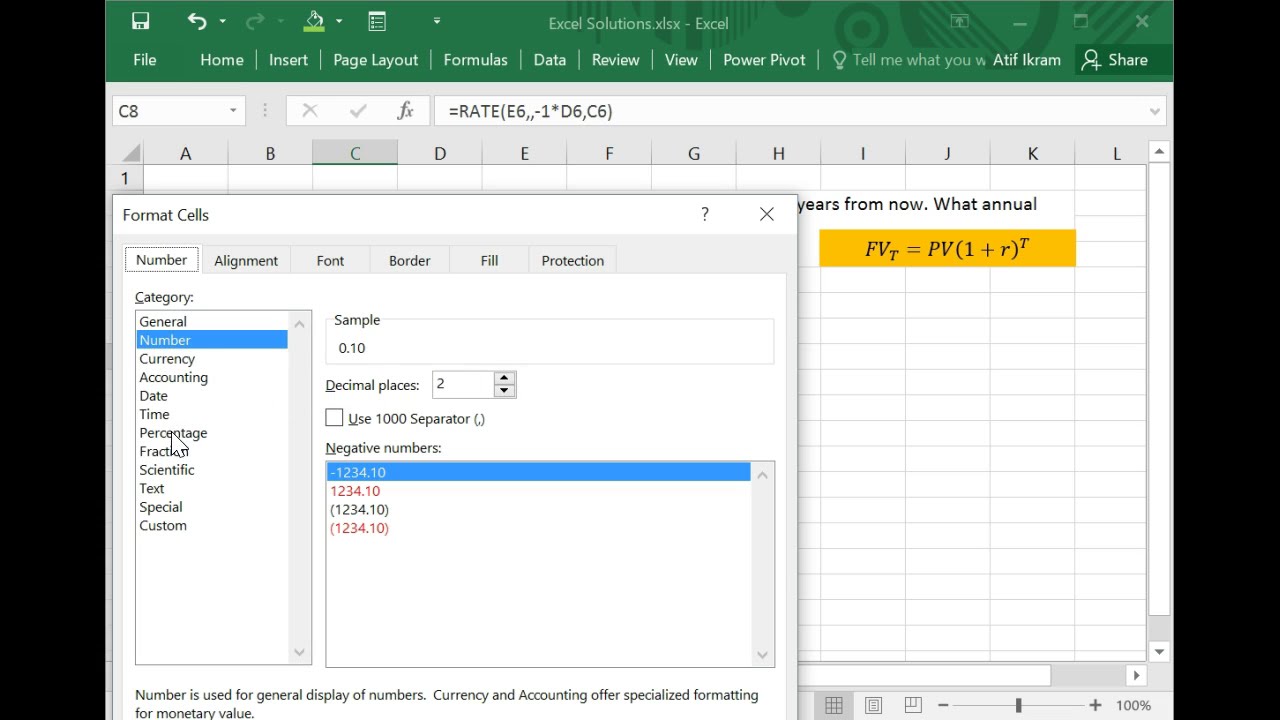

The newest cost name of your FHA Particular step 1 Loan try between 6 months and 20 years as well as thirty two weeks. There’s no prepayment penalty. Rates throughout these money believe the lending company where in actuality the financing try acquired and are repaired. Adjustable interest levels commonly available. The level of rates in the wider benefit in addition to creditworthiness of your borrower are two other variables which help so you’re able to dictate interest levels.

Conditions

The application form procedure into FHA Form of step 1 Loan is like a mortgage but perhaps not because the rigid. The lender often remove new borrower’s credit file and check out the credit history. Income would-be appeared through tax yields and W-2s to guarantee the debtor is also repay the borrowed funds, however, there is not any particular money needs. The debt-to-money ratio should not be over forty five%, while must have occupied our home getting no less than ninety days.