It’s also important to invest vs. just saving because saving cash just won’t grow fast enough to be useful to you. See the average return by asset class below (and notice how your own wage growth doesn’t keep up well either). No matter what venture you undertake in life, you need a team. I’m a firm believer in team work, even if it is just to bounce ideas off of, or to have someone tell you that you are off track. For many individuals, this person is their spouse, who also brings some income diversity to the table.

Interesting Truths About Niching Down Vs. Many Streams Of Income – Forbes

Interesting Truths About Niching Down Vs. Many Streams Of Income.

Posted: Mon, 10 Apr 2023 07:00:00 GMT [source]

If you’re into antiques, for example, you could check out garage sales for hidden deals and then capitalize on your knowledge to turn a profit. Perhaps you’re into video games, specific brands of clothing, or something else. For example, if you buy Tesla stock for $100 and sell it for $200, you have made a capital gain of $100. Or, if you invest in bonds, you will receive interest payments from the bond issuer. It’s the most common and well-known type of income, but it’s also the least passive.

Heck, some people think $50,000 is enough when really, they should have a whole lot more because they have a high income or a lot of debt. Whatever it is, with a little research, it’s possible to turn your knowledge into cash with an eBay store. Best of all, you can sell from the comfort of your own home.

Because the more ways you can earn money without compromising your integrity, the better off you’ll be. And if you’re self-employed, having multiple income streams is almost essential. Not only will you enjoy a higher income, but you won’t go broke if one stream ends out of the blue.

Income Stream #4: Affiliate Marketing

Deposit products and services are provided by City National Bank Member FDIC. These six options are just a few ideas for how to earn money from more than one source. Also, unless you’re extremely well-known in your field already, you’re not likely to earn a large income from speaking engagements or similar work. However, building the foundation for future income can be rewarding in the long-term.

How to manage work-life balance with multiple income streams – Fast Company

How to manage work-life balance with multiple income streams.

Posted: Wed, 05 Apr 2023 07:00:00 GMT [source]

REITs are a way to invest in real estate without having to put in all the effort that comes with managing properties. REITs typically pay out the majority of their income in dividends, making them an attractive option for investors looking for passive income. Of course, you’ll want to make sure that putting effort into a new passive income stream isn’t causing you to lose focus on your other streams. So you do want to balance your efforts and make sure you’re choosing the best opportunities for your time. Investing can be a great way to generate passive income, but only if the assets you own pay dividends or interest. Non-dividend-paying stocks or assets like cryptocurrencies may be exciting, but they won’t earn you passive income.

Explore the blog

I can’t image that anyone wouldn’t be able to find several ideas that fit for them. The ideas in this book can easily be implemented to begin creating multiple streams of income immediately. Like I said earlier, there is a wealth of information here and it feels impossible to soak it all in with just one read. It’s something that might need to be re-read and studied over and over.

The staggered maturities allow you to decrease reIllinois income tax rate risk, which is the risk of reinvesting your money when bonds offer too-low interest payments. Economic stress can also cause some companies to cut their dividends entirely, while diversified funds may feel less of a pinch. Shareholders in companies with dividend-yielding stocks receive a payment at regular intervals from the company.

- Europeans don’t enjoy the liberties an American might so naturally a book focussing on the American market and economics isn’t going to be as useful to Europeans in that sense.

- As long as it’s something I believe in and support, it’s a win-win.

- Ride-share drivers can work for multiple companies at the same time, so you can drive for both Uber and Lyft at the same time to maximize your earnings.

- If the REIT doesn’t generate enough income, it will likely have to cut its dividend or eliminate it entirely.

- Whether it’s financial freedom or more free time you’re looking for, putting in the extra work and creating multiple streams of income is worth it.

Managing multiple streams of income can get complicated fast. The point of having multiple income streams is to grow your wealth and meet your financial goals so that your portfolio and your life can live up to their maximum potential. But this likely won’t happen if you generate passive income and allow it to stay passive.

We are a Houston-based wealth management firm offering comprehensive, specialty financial services to high-net-worth individuals, families, and business owners. I also invested in other ‘hands off’ real estate investment products to add to the income sources. I started first with a home based business, to provide additional income. This was smart as it was low investment but quick return and it had residual income inside the business model. Robert Allen shares so many ideas for multiple streams of income in this book.

Social Media

For the past several years, I’ve invested a portion of my money in small companies who require seed money or capital for inventory. I’m not going to go into too much depth on my stock strategy but I generally invest in companies that I know and understand. For example, I’ve held Microsoft and Oracle since the 80’s and these stocks continue to climb every year. A large part of wealth generation is putting your money to work. By using a specially tagged link, you can earn a commission when someone clicks on your link and signs up for a product or service you recommend. When I started documenting my ecommerce journey on MyWifeQuitHerJob.com, I attracted many readers who wanted to learn from me directly.

Print on demand, or POD, is a dropshipping business model that lets anyone design and sell printed products without any upfront investments. The internet and technology have changed how we make money. Having multiple income streams is more accessible than ever – all you need is to pick your path and dive in head first. It comes from a salary, hourly wage, or commission for specific duties or services you provide. A common source of active income is a regular day-to-day job. In order to increase your wealth, you must be able to live within your means.

In fact, often starting your own business doesn’t even look like starting a business anymore. Almost all freelancers, for example, operate a small business even if they have never formally incorporated. Anyone selling on Etsy, writing a blog or running a YouTube channel is operating his or her own business.

Well-timed investments in companies can generate excellent passive income streams. Yes, it is possible to create multiple income streams while working a full-time job. This article is for anyone interested in creating multiple streams of income with both active and passive income. Today, I have 10 income streams and I’ll be sharing what these multiple income streams are, which are active or passive income, and how you can do the same. We’ve mentioned several passive income streams in this article. Passive income lets you earn money while not actually doing the work.

Rich Dad Poor Dad – Build Multiple Streams of Income

If you’re still on the fence about whether it’s worth having multiple income streams, look at some of the main benefits you get when adding other income streams to your full-time job. Real estate syndications are one of the best passive sources of income. A syndication is a group of investors that purchase a particular multi-family or commercial property.

Mini Income Streams Reviews: Rachel Rofe 2023 Low Hanging System Revealed by Online COSMOS Expert – Outlook India

Mini Income Streams Reviews: Rachel Rofe 2023 Low Hanging System Revealed by Online COSMOS Expert.

Posted: Tue, 18 Apr 2023 11:38:56 GMT [source]

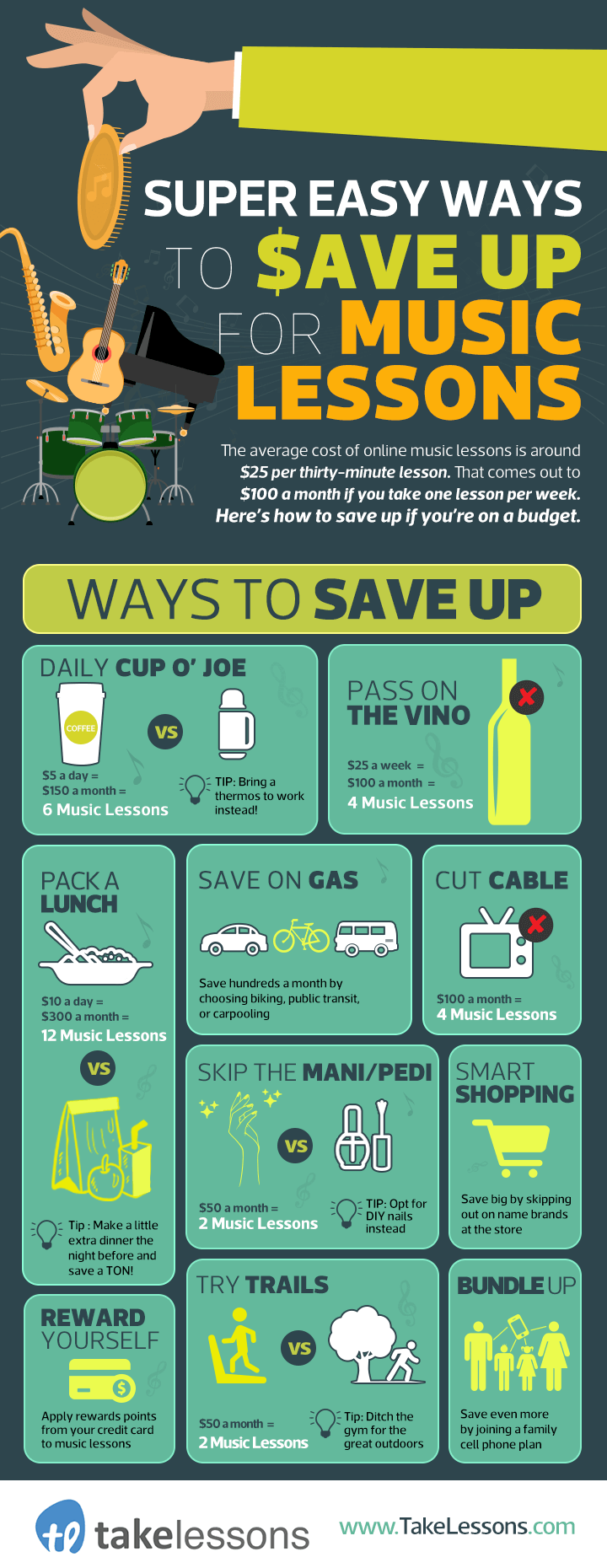

Both will get cash in your pocket, but there’s a difference in the level of effort you have to dedicate to each one. You might’ve read that the average millionaire has seven income streams. While there’s no data to back that up, it makes a lot of sense. The more income streams you can build, the quicker you’ll be able to realize your financial objectives. Having more income streams might mean you can actually work less. Passive income, such as investments, digital products, and online courses, can give you increased flexibility in the amount of hours you need to work.

Our mission is to empower women to achieve financial success.

Teachable regularly bring in thousands of people eager to learn. A new survey offers a get-real guide for first-time homebuyers in the U.S. Here’s how leaders can foster an environment that encourages productive debate and empowers individuals to challenge ideas rather than go with the flow. Peer-to-peer car rentals have become remarkably popular, thanks to a shortage on the market.

Begin by picking one stream of income that you’re deeply passionate about. For some people it will be real estate, and for others it will be owning your own business. In short, there’s a price to pay for each stream of income, and only you can decide if multiple streams of income are truly worth that price.

Best Items To Resell For Extra Cash!

Or, better yet, hire an advisor to do the tracking for you. It allowed me to quit my day job, to get out of the 9-5 rat race and the daily commute, and to spend more time with my family. In other words you are not dependent on one source of income. Unfortunately, for him, he has explained in the audiobook that his “products” are nothing but smoke and mirrors. Having said that, it was nonetheless an interesting read, if not quite dated on the chapter about the internet. I wouldn’t hesitate to recommend this book to any American citizens as I feel the biggest benefits are reserved for those living under American law and the American market.

Bumblebee Linens is one of my biggest and most stable income streams. I still remember when I told my friends that I wanted to sell hankies online, they all thought I was crazy. I’ve interviewed over 350 wealthy entrepreneurs on my podcast and here’s an interesting fact. If you don’t have enough knowledge or time to keep track of financial markets, try using the services of a professional broker or use a robo-advisor.

Consider working with a financial advisor on how best to augment your income. You can increase your investment portfolio income streams by investing in company stocks, bonds, and various types of stock market funds. Do this with the goal of having your investments grow over time and, in turn, earning portfolio income. If you’re looking to build wealth and financial stability, diversifying your streams of income can be a powerful strategy.